Lawmakers have advanced six draft bills intended to ensure Wyoming electricity customers pay only what’s necessary for utilities to provide reliable energy without lining executives’ pockets or footing the bill for other states’ demands for renewable energy.

The legislative efforts attempt to fill perceived regulatory gaps in a rapidly changing utility landscape, according to Corporations, Elections and Political Subdivision committee members who debated the bills Friday in Cheyenne. Though some measures were criticized as redundant of existing utility practices and Wyoming Public Service Commission authority, and for adding to the under-staffed commission’s workload, they’re also intended to send a message.

“A big part of what we’re doing is perception,” Rep. Jeremy Haroldson (R-Wheatland) said. “We’re having this conversation and [residents] want to know without a shadow of a doubt that when they pay their utility bill next month they’re not paying for another state’s decisions.”

All six bills will be sponsored by the committee. Bills sponsored by legislative panels are historically more likely to succeed than measures backed by individual lawmakers.

Despite the two-thirds vote threshold required to introduce non-budget bills in February’s budget session, committee members are hopeful the high-profile issue of soaring electric rates will win consideration for the slate of utility measures before the Legislature.

Lawmakers said they’re responding to rising utility costs, in general, and worry the industry’s ongoing shift from fossil fuels to renewable sources of electric generation will result in continually rising rates and less reliable power.

Panel members repeatedly pointed to Rocky Mountain Power’s request to hike electric rates by nearly 30% — the largest hike Wyoming has seen in more than 10 years and a move lawmakers believe is, in large part, the result of anti-coal and natural gas policies in several West Coast states where the utility’s parent company, PacifiCorp, also operates.

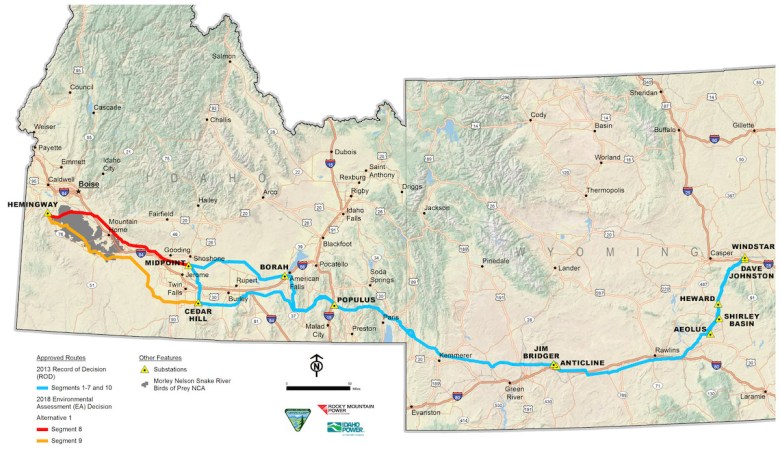

The company’s ongoing investments in new Wyoming wind farms and high-voltage transmission lines to send the power to customers in other western states is a primary example, Corporations Committee Co-Chairman Sen. Cale Case (R-Lander) said. Though it’s not a major factor in Rocky Mountain Power’s current rate hike requests, its parent company is investing $8 billion in interstate electric transmission lines, adding more future costs and risks for Wyoming customers without a proportional benefit, according to Case.

“Those lines, the commission is going to find that they’re [a just and reasonable expense],” Case said. “Do you think they’re useful for Wyoming? I don’t. I think we’re getting screwed.”

The committee, over the course of about eight hours, heard testimony from the Wyoming Public Service Commission, Rocky Mountain Power, Montana-Dakota Utilities Co., Black Hills Power, Wyoming Rural Electric Association, Wyoming Industrial Energy Consumers and several members of the public. The discussion often invoked the Rocky Mountain Power rate hike hearing taking place before the Public Service Commission just a couple blocks away from the Capitol, with some of the same parties in that case taking time to hash out their arguments in the legislative setting.

Sen. Case, for example, is participating in the rate case hearing as a citizen. Holland and Hart attorney Thor Nelson represents the Wyoming Industrial Energy Consumers coalition — also an intervening party in the rate case — and testified before the legislative committee in support of several bills the coalition offered and that the committee accepted.

Meantime, the Public Service Commission and Rocky Mountain Power sent staff members and representatives not directly participating in the rate hearing to testify before lawmakers.

The Public Service Commission is expected to rule on Rocky Mountain Power’s rate request before January, long before any potential new legislation might take effect — or even be debated by the full Legislature.

Nearly all aspects of the draft measures exempt rural electric co-ops because the state has limited authority over their rates or facility investments. Rocky Mountain Power is the primary target for much of the draft legislation affecting all regulated electric utilities in the state because it is the largest in Wyoming, serving some 144,000 customers, according to statements by lawmakers.

Here is a summary of the six draft bills advanced by the committee.

Public service commission – electricity reliability would direct the commission to establish standards for “adequate, dispatchable and reliable” electric generation and to impose penalties for outages and for not meeting the standards. The committee considered, but backed off from, increasing penalties to a potential maximum of $1 million per day for a major outage.

The new reliability standards would be applied only to electric generation facilities and not distribution systems, such as power lines.

Utilities are already held to such standards and potential monetary penalties by both state and federal authorities, utility representatives testified. However, the new standards should compel utilities to be careful not to become over-reliant on renewable sources of electric generation, and should give the commission “more teeth” to disallow passing the cost of renewables to Wyoming ratepayers, Sen. Charles Scott (R-Casper) said.

Reclamation and decommissioning costs would direct the commission to hire a third party to study the cost of closing and remediating power plants. The bill includes an appropriation of $500,000, which would be recouped from power plant owners — an expense that committee members said should not be passed on to ratepayers.

However, both the commission and utilities already account for reclamation and decommission costs in rates, according to testimony from their representatives. The money is collected in pace with scheduled closures. Further, the measure would add to the workload of an already understaffed commission and potentially require another $1 million in staff support, according to an estimate by the agency’s Chief Counsel John Burbridge.

Despite existing laws and rules, several lawmakers still worry that divvying up power plant closing costs among ratepayers in multiple states might become more complicated than usual. For example, Wyoming might choose to support a coal-fired power plant long after states like Washington and Oregon have opted out. That scenario, too, according to critics of the draft bill, is already taken into account within the existing regulatory system.

“Perhaps it’s a solution looking for a problem,” Burbridge told the committee.

Electricity rates for costs that do not benefit Wyoming would direct the commission to conduct a cost-benefit analysis of multi-state, systemwide facilities and disallow any costs that do not benefit Wyoming ratepayers. It attempts to address concerns such as the example that Case mentioned regarding PacifiCorp’s $8 billion investment in new interstate transmission expansions necessary to deliver power from expanding wind and solar energy facilities to out-of-state customers.

“We are not benefiting from that in any proportion to the cost that our ratepayers are being asked to [pay],” Case said.

PacifiCorp’s $8 billion investment accounts for only a fraction of Rocky Mountain Power’s currently proposed rate hike, according to the utility. Just how much Wyoming ratepayers are being asked to cover, and how much is legally justified, is now being contested before the Public Service Commission.

The bill does appear duplicative of the commission’s core mandate to scrutinize the costs of multi-state, systemwide facilities and to only allow utilities to recover the portion that’s proven to serve Wyoming customers, Case acknowledged. But he and most of his colleagues on the committee are convinced the current level of regulatory scrutiny still leaves Wyoming customers vulnerable to paying more than their fair share.

Also, Case said, the regulatory calculations don’t take into account the environmental, cultural and natural resource losses imposed on Wyoming by industrializing landscapes with wind farms and transmission lines.

“Those lines are being built for the major purpose of taking renewable energy out of the state of Wyoming,” Case said. “We don’t need that power. Our customers don’t need that power. Our growth doesn’t justify that power, and on and on and on.”

Only a small portion of a multi-state utility’s wind farms and interstate transmission lines might serve Wyoming customers. But they more broadly benefit them via economies of scale when it comes to geographically large, systemwide savings, according testimony from utility representatives. Though utilities didn’t oppose the measure, the bill merely adds another layer of work and expense for something the utilities and the commission already do, they said.

“It really doesn’t advance the ball very much because this is essentially what is done anyway,” said Bruce Asay, who represents Montana-Dakota Utilities Co.

Public service commission-integrated resource plans was brought to the committee by the Wyoming Industrial Energy Consumers coalition, and it has tentative support from the Sheridan-based landowner advocacy group Powder River Basin Resource Council.

The bill would direct state regulators to more closely review a utility’s long-range planning and provide guidance for how the utility can better meet Wyoming’s needs and policies.

Utilities routinely update what’s referred to as their integrated resource plan — a roadmap of sorts for how they will provide electrical service well into the future. Rocky Mountain Power, for example, filed its most recent 20-year integrated resource plan update in April, setting tentative retirement dates for several coal-fired power units in Wyoming and neighboring states as well as plans for major investments in new transmission lines, renewable energy and battery storage.

The internal utility-by-utility planning process tends to set an agenda and investment plan in motion ahead of deeper scrutiny by state-level authorities such as the Wyoming Public Service Commission and the broader public, proponents of the bill say.

“So it ends up having an elevated presence and less scrutiny, I argue, than if we had scrutinized it at the very front end,” Case said.

Utility representatives said the bill would result in additional layers of work for both them and the commission, but they did not oppose the measure.

“We do this in Utah. We do it in Oregon. We’re happy to do it in Wyoming,” Rocky Mountain Power Vice President and General Counsel of Government Affairs Richard Garlish said.

One particularly unpopular aspect of Rocky Mountain Power’s contested 21.6% (or $140.2 million) “general rate” increase proposal is another request couched within it.

Currently, the utility operates under a “cost sharing band” — a regulatory mechanism that splits fuel cost overruns between the utility and its Wyoming customers. Ratepayers are tapped for 80% and the utility is responsible for 20%. The same 80/20 ratio applies when fuel costs come in lower than the amount fixed into rates, sometimes resulting in a rebate to customers.

That type of shared risk and benefit is a good “insurance” policy for ratepayers, and incentivizes the utility to do its best in forecasting prices for wholesale coal and natural gas to fuel power plants, as well as electrical power it sometimes purchases on the open market, according to the Wyoming Office of Consumer Advocate.

But Rocky Mountain Power wants Wyoming authorities to shift that cost sharing band to 100/0 — requiring Wyoming ratepayers to accept all the risk and reward, depending on how well the utility has estimated future fuel costs.

The Public utilities-net power cost sharing ratio draft bill would disallow a 100/0 ratio and mandate that the risk and reward be shared to some degree. Though many proponents of the measure support a permanent 70/30 split, the committee declined to establish a specific ratio — only that it could not be 100/0.

Rocky Mountain Power representatives strongly opposed the measure.

Lawmakers and large Rocky Mountain Power customers, particularly the Wyoming Industrial Energy Consumers coalition, worry that the utility’s process for inviting bids from contractors puts potential fossil fuel developers at a disadvantage.

Public utilities-energy resource procurement mimics existing laws in Utah and Oregon that call for an independent evaluator to judge whether a utility’s “requests for proposal” faithfully solicit a full range of technology options for new power generation facilities regardless of their primary energy resource.

Though the commission considers it redundant of current practices and authority, utilities did not oppose the measure. A Rocky Mountain Power representative noted the company already undergoes similar scrutiny in Utah and Oregon.

One measure, Third party electrical generation, which would have allowed groups of customers to generate and potentially sell their own electricity, failed to move forward.

It’s a form of deregulation, according to critics, and an ongoing legislative effort that’s been defeated in the past. But it’s likely to reappear before the Legislature given strong support among Wyoming’s trona, natural gas and manufacturing industries, as well as bitcoin miners.

Explore our curated content, stay informed about groundbreaking innovations, and journey into the future of science and tech.

© ArinstarTechnology

Privacy Policy