The 2025 Honda CR-V e:FCEV plug-in hydrogen fuel cell electric vehicle will be available in California later this year.

The first hydrogen fuel cell consumer vehicle for America was announced Tuesday by Honda.

With a name that doesn’t quite roll off the tongue, the CR-V e:FCEV combines a hydrogen fuel cell system with plug-in charging capability and has an EPA driving range rating of 270 miles.

Honda stated the vehicles will be available for customer leasing in California starting later this year and expects initial sales of 2,000 units annually.

Co-developed with General Motors, Honda said the CR-V e:FCEV’s new fuel cell system, made in Michigan, offers improved durability, higher efficiency, and lower cost compared to Honda’s previous-generation fuel cell system.

The new vehicle, produced in Ohio, includes a 110-volt outlet that delivers 1,500 watts of juice for powering items such as small home appliances, portable air conditioners, power tools, and camping equipment.

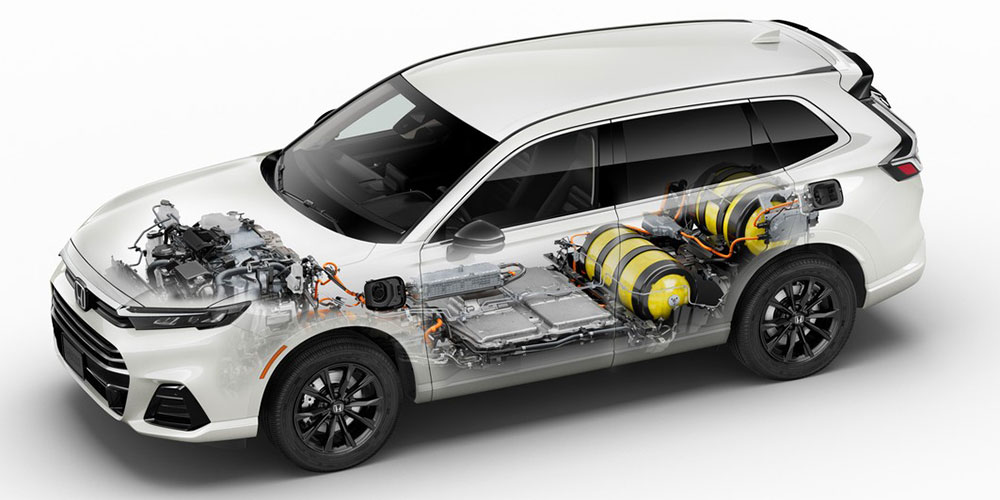

Cutaway view of the 2025 Honda CR-V e:FCEV internal components

Honda also stated it has doubled the durability of its fuel cell system by applying corrosion-resistant materials and controlled suppression of deterioration, as well as improving the low-temperature performance of the system.

“It is interesting to see Honda re-entering the market, having canceled its Clarity in 2021 due to poor sales. It shows there is still certainly interest in the technology,” said Rasmy John, business development manager at IDTechEx, a global market research firm.

“One of the main barriers to fuel cell vehicles is the greater upfront cost,” she told TechNewsWorld. “The announcement does not state an estimated price for the vehicle but does state they have managed to reduce the fuel cell cost by two-thirds compared to the previous Clarity, which could aid in seeing the cost become comparable to a battery electric vehicle.”

“However,” she continued, “given the range is largely similar to many battery electric cars today, and EV charging infrastructure is so much more widely developed, it could still be a challenge for fuel cell cars to see market success.”

Fueling infrastructure has been a formidable barrier to the adoption of both fuel cell and battery-electric vehicles (BEVs).

“Fuel cells and EVs share the same challenge in terms of an inadequate fueling infrastructure, but there are orders of magnitude more EV charging points than hydrogen stations,” said Edward Sanchez, a senior analyst in the automotive practice at TechInsights, a global technology intelligence company.

He explained that there are an estimated 41,000 publicly accessible charging points in California, compared to 55 hydrogen fueling stations in the state, a third of which are in Los Angeles County alone. Nationally, he continued, there are approximately 140,000 public charging points and 59 hydrogen fueling stations, almost all of which are in California.

2025 Honda CR-V e:FCEV at a hydrogen refueling station

“Plus, the cost of building out a hydrogen fueling infrastructure is much higher than installing EV charging points, and on a chemical/molecular level, hydrogen is challenging to store and distribute,” Sanchez told TechNewsWorld.

“The biggest hurdle remains fueling infrastructure,” he said. “This is also an issue with EVs, but the biggest difference is EV charging stations can be set up relatively quickly and at comparatively low cost compared to hydrogen, which requires much more expensive hardware and infrastructure.”

“The vehicles themselves have proven reliable for the most part,” he added. “Fueling infrastructure is hydrogen fuel cells’ biggest Achilles’ heel.”

“Hydrogen-powered cars, whether fuel cell or combustion, have never caught on in the mainstream, especially in the U.S., largely due to challenges with the fueling infrastructure, which has had major issues in reliability and uptime,” Sanchez observed.

Markets aren’t driving adoption in other countries, either. “The Japanese OEMs’ interest in hydrogen has been largely driven by incentives and encouragement by the Japanese government,” Sanchez said.

“The CRV is likely best seen as a demonstration that the tech works and to work out any kinks in the fuel cell and related ecosystem before much more expensive platforms are asked to use it. A hydrogen-powered FCEV [fuel cell electric vehicle] heavy truck will cost upwards of $800,000 before subsidies,” added Robin Gaster, a non-resident senior fellow at the Information Technology & Innovation Foundation, a research and public policy organization in Washington, D.C.

“Initial sales at 2,000 don’t suggest any intention to make this a mass-market product, even if this is only the first-year target,” he told TechNewsWorld.

John noted that battery electric cars are deployed in much larger numbers and are already becoming widely accepted. He pointed out that in 2023, over 9.6 million battery electric cars were sold across China, Europe, and the U.S., 32% more than the previous year. In comparison, sales of fuel cell cars were only around 8,500 globally, nearly half of the year before.

“Hydrogen-powered vehicle sales have collapsed in South Korea — two were sold in January — despite massive subsidies, and there is no traction in California either,” contended Gaster.

“Bluntly,” he continued, “BEVs have zoomed past hydrogen as the preferred clean power option for light vehicles. They will soon be out of sight, and manufacturers will switch to heavy vehicles, where hydrogen won’t win either, though the race is slightly closer.”

Fuel cell systems may be better suited for heavier vehicles, especially long-haul trucks, maintained Sam Abuelsamid, principal analyst for e-mobility at Guidehouse Insights, a market intelligence company in Detroit.

“The amount of battery that you need for a long-haul truck is prohibitive because of the time it takes to charge it,” he told TechNewsWorld. By contrast, the time to refuel a fuel cell is on par with the time it takes to fill a gas tank.

Long-haul trucks also travel fixed routes, enabling better control of infrastructure costs.

“Consumers want to drive wherever they want and want infrastructure everywhere,” Abuelsamid said. “For long-haul trucking, you really only need to build fueling stations along major routes so you can have fewer hydrogen stations to support that use case.”

But even the heavy-truck window may be closing fast on FCEVs. “The MCS [Megawatt Charging System] protocol in development with CharIN [Charging Interface Initiative] is aiming to bring the time to recharge to near parity with diesel or fuel cells,” Sanchez said.

“If this premise is proven in the real world, and adequate heavy truck charging infrastructure can be built that would effectively cover national trucking routes, this could potentially deal a fatal blow to hydrogen in the heavy truck market going forward.”

Explore our curated content, stay informed about groundbreaking innovations, and journey into the future of science and tech.

© ArinstarTechnology

Privacy Policy